Nearing Retirement? Be Sure You’re Managing This Big Risk

Remember that catchy, bouncy little pop song ‘Break My Stride’ by Matthew Wilder from the 80’s?

“Ain't nothin' gonna break my stride

Nobody gonna slow me down

Oh no, oh no, I got to keep on moving…”

- Songwriters: Matthew Wilder / Greg Prestopino

Clearly, there’s a lot to think about when planning for retirement. And while we have a degree of control over many of the choices involved, there’s one big risk that could break your stride - sequence of returns risk.

Sequence risk is the risk that you’ll encounter negative investment returns in early retirement. This is an important consideration, because the random sequence – or order – in which you earn your returns early in retirement can have a significant impact on your lasting wealth. Simply put, a retirement portfolio that happens to experience positive returns early in retirement will outlast an identical portfolio that must endure negative returns early in retirement … even if their long-term rates of return end up the same.

Since nobody can predict which return sequence they’ll experience early in their retirement, every family should prepare for a range of possibilities in their realistic retirement planning.

The Significance of Sequence Risk

It’s no secret that global stock markets are volatile. While long-term average annual returns may be in the range of 7%, markets rarely deliver this exact average any given year. Soaring one year, plummeting the next; we never know for sure how far above or below average each year will be.

During your career, you’re mostly spending earned income, while adding to your retirement reserves as aggressively as your plans call for. As long as you stay the course – benefiting from the upswings and enduring the downturns – tolerating market volatility is just part of the plan.

In fact, when you’re still accumulating wealth, market downturns give you the opportunity to buy more shares than you otherwise could when prices are higher. When the market recovers, you then have more shares to recover with, which ultimately strengthens your portfolio.

But then, you stop working, and start spending your reserves. This has an opposite effect. Now, when stock markets decline, you may need to sell shares at low prices, which means you’ll have to sell more of them to withdraw the same amount of cash. Even though the market is expected to eventually recover and continue upward, your portfolio will have fewer shares with which to participate in the recovery. This hurts your portfolio’s staying power. It won’t be able to bounce back as readily as when you were adding shares to it, or at least not taking them away.

Sequence Risk Illustrated

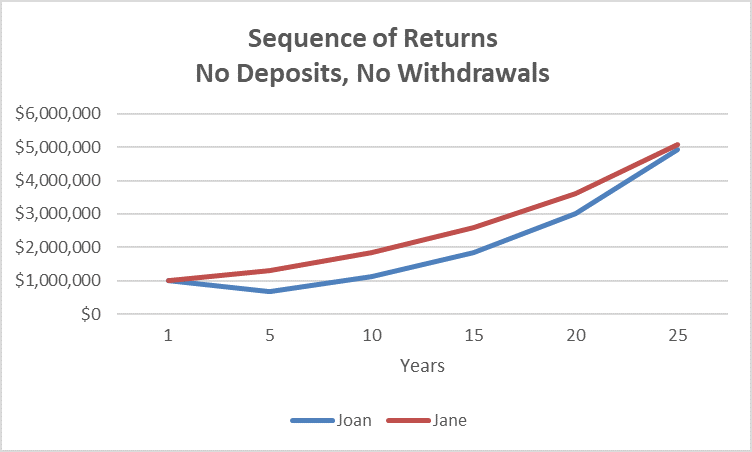

Consider two hypothetical retirees, Joan and Jane:

Both retire at age 65 with identical $1 million dollar stock portfolios.

Both start withdrawing $50,000 annually at the start of each year (not adjusted for inflation).

Both earn the same 7% average annual returns over their 25 years in retirement.

With so much in common, you might assume their portfolios would perform similarly. But what if Joan happens to enter into retirement during a horrible market? Let’s imagine her portfolio returns –30% and –20% in her first two years, while Jane earns 7% both years, and (implausibly) every year thereafter.

Markets recover nicely for Joan after two years so, again, she ultimately earns the same average 7% annual return as Jane. But sequence risk takes a heavy toll on Joan’s remaining shares. She ends up with only about $150,000, while Jane’s portfolio grows nicely to around $2 million.

[This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing]

Now, if we take the same two portfolios and same two sequences of returns – but eliminate the $50,000 annual withdrawals –Joan and Jane would both end up with about $5.4 million after 25 years. This illustrates why sequence of returns is usually not nearly as significant when you’re still accumulating wealth, but can matter quite a bit in the early years of depleting your portfolio.

[This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing]

Managing the Sequence Risk Wild Card

Sequence risk should NOT change your overall approach to investing. As 2020 has clearly shown us, you never know what’s going to happen next. Crashes usually occur without warning, while some of the strongest rebounds arrive amidst the darkest days.

So, whether you’re 20, 40, 60, or 102, we still recommend building and maintaining a low-cost, globally diversified portfolio that reflects your personal goals and risk tolerances. We still advise against trying to pick individual stocks or react to current market conditions. We still suggest you only change your portfolio’s asset allocations if your personal goals have changed – never in raw reaction to changeable market moods.

What can you do to mitigate sequence risk if it happens to you?

Keep working. If you are willing and able, you might postpone retirement, or even return to the workforce. Even part-time employment can help offset an ill-timed sequence of negative market returns. If your circumstances allow, you may be able to not only avoid spending retirement reserves during down markets, but even add more in (buying at bargain prices).

Spend less. Were you planning for higher investment returns than reality has delivered? Since your portfolio is most vulnerable to negative sequence risks early in retirement, you may want to initially spend less than planned, to give your portfolio the fuel it needs to replenish itself.

Tap other assets. When you retire, you typically have several sources of income to draw from. You may have traditional investment accounts, retirement accounts, Social Security, or pension plans. Your investments are usually divided between stocks and bonds. You may have equity in your home. You may have, or be in a position to create an annuity. You may have cash reserves. If you encounter stock market sequence risk early in retirement, you might be able to tap a combination of your non-stock assets for initial spending needs. This can mitigate the hit your portfolio will otherwise have to take if you must liquidate shares of stock.

Consult with a financial advisor. Sequence risk is usually not the only consideration at play in retirement planning. There are taxes to consider. Estate plans to bear in mind. Carefully structured investment portfolios to maintain. Logistics to learn. All this speaks to the value an experienced advisor can add before, during, and after this pivotal time in your financial journey.

At WealthBuilders, we help our clients prepare for and mitigate sequence risk within the greater context of their goals for funding, managing, spending, and bequeathing their lifetime wealth.

Please be in touch today if we can help you with the same.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

Asset allocation does not ensure a profit or protect against a loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

WealthBuilders Inc. and LPL Financial do not provide specific individualize tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

![[This is a hypothetical example and is not representative of any specific situation. Your results Will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing]](https://images.squarespace-cdn.com/content/v1/58efeb5ff5e231091c3c0b33/edd3dda8-2718-4515-bc0d-51fba89c8114/Graph+1.png)